Again, AMCON begs judiciary to help recover N5trn debt

With a staggering N5 trillion trapped in the hands of recalcitrant debtors, the Asset Management Corporation of Nigeria (AMCON), has once again called on the judiciary to come to its rescue.

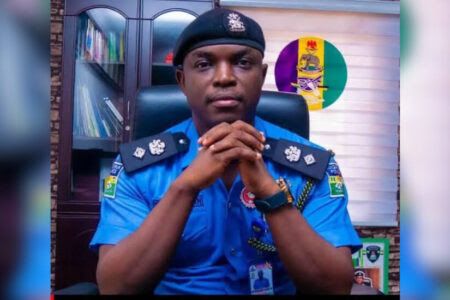

The latest call came from the Managing Director and Chief Executive Officer of AMCON, Mr. Gbenga Alade, who appealed to the judiciary to expedite the resolution of AMCON-related cases in line with the 60-to-90-day timeline stipulated in the AMCON Act.

He emphasised that judicial efficiency is critical to the corporation’s mission of recovering billions of naira in outstanding debts.

Alade, who spoke at a Stakeholders’ Retreat with the Senate Committee on Banking, Insurance and Other Financial Institutions, held in Lagos at the weekend, highlighted the soaring backlog of over 3,000 cases currently pending in courts across the country.

“We have more than 3,000 cases in various courts, from the courts of first instance to the Supreme Court. We have continued to deepen our interaction with the leadership of these courts to ensure timely resolution of these cases,” Alade said.

He stressed that adhering to the statutory timeline for adjudication is vital for AMCON’s operations. “Our hope is that AMCON cases would be adjudicated within the time limit enshrined in the AMCON Act. We are not asking for special treatment—just what the law prescribes,” he added.

Alade also urged lawmakers to help sensitise government agencies about the risks of engaging contractors or entities with unsettled debts to AMCON, noting that such practices undermine debt recovery efforts.

However, despite the challenges, Alade noted that AMCON has made substantial progress.

He reported that the Corporation has recovered approximately N2.011 trillion since its inception, with 44% from cash recoveries and 56% through the sale of assets, clawbacks and other mechanisms.

Additionally, AMCON has disposed of assets valued at N651 billion, contributing to the preservation of jobs and the rescue of distressed businesses nationwide. Between 2013 and 2023, the corporation also paid N2.929 trillion to the Central Bank of Nigeria (CBN), including contributions from the Sinking Fund and recoveries.

However, Alade raised concerns about the future of AMCON, noting divided opinions on whether the corporation should be wound down or extended. He warned that closing AMCON prematurely could lead to the resurgence of non-performing loans and potential instability in the financial sector.

“One wonders if lessons have been learned from the challenges of the past. Allowing unresolved debts to linger could spell trouble for the nation’s financial system,” Alade cautioned.

He criticised some obligors who, rather than settling their debts, exploit the judicial system to delay payments. “These individuals hope that as AMCON’s sunset date approaches, they can escape their obligations, leaving taxpayers to bear the burden. We will not allow this to happen,” he affirmed.

Alade disclosed that just 350 obligors account for over 70% of AMCON’s total debt portfolio.

“It is troubling that many of these individuals continue to live in luxury, fly private jets, and secure government contracts, while their debts remain unpaid,” he noted.

In his submission, Senator Adetokunbo Abiru, Chairman of the Senate Committee on Banking, Insurance and Other Financial Institutions, commended AMCON’s efforts in stabilising Nigeria’s financial sector.

He noted that the Corporation played a crucial role in injecting liquidity into the banking system during the global financial crisis of 2008.

“The establishment of AMCON was a pivotal intervention that not only stabilized the banking industry but also saved thousands of jobs and restored confidence in the financial sector,” Abiru stated.

He acknowledged, however, that AMCON was never intended to be a permanent entity. “With its life extended through the AMCON Amendment Act of 2021, we must now chart a path forward as we approach the 2026 sunset clause,” he said.

Abiru urged stakeholders to consider innovative strategies, such as the adoption of models like Korea’s Asset Management Corporation (KAMCO), to enhance debt recovery. He also stressed the importance of channeling recovered funds into critical sectors such as education, healthcare, and infrastructure.

“The recovery of taxpayers’ money used to purchase Eligible Bank Assets (EBAs) is vital, especially now, as many businesses grapple with severe economic challenges,” he stated.

THE SUN