Wike, Ango, And The FCT Revenue Drive

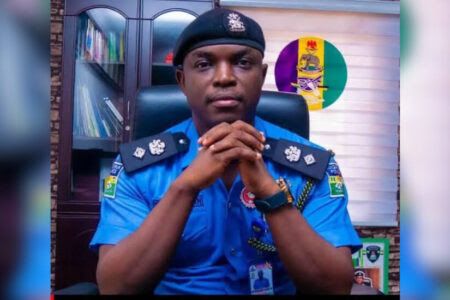

The recent appointment of Mr. Michael Hadi Ango as Acting Chairman of the Federal Capital Territory Internal Revenue Service (FCT-IRS) has drawn significant attention, especially from economic analysts. Ango’s wealth of experience in revenue administration, financial management, and organizational leadership makes his appointment timely, aligning with the ambitious revenue goals set by Nyesom Wike, the FCT Minister. With the Federal Capital Territory’s (FCT) growing economic importance and its role as a business hub, Ango’s expertise and Wike’s leadership signal a new era for revenue administration.

Mr. Ango brings over two decades of experience in both public and private sectors, having held key roles in revenue administration and policy reform with organizations such as Andersen LP, KPMG, the Federal Inland Revenue Service (FIRS), and Guinness Nigeria PLC. His experience in revenue management, policy advisory, and financial regulation equips him to address the challenges ahead at FCT-IRS.

Ango’s educational background is equally impressive. He holds a Bachelor of Laws degree from Ahmadu Bello University, an LLM from Columbia University, and has completed executive training at Harvard’s Kennedy School. His knowledge of global best practices in tax policy and administration is reflected in his appointments to the Presidential Committee on Fiscal Policy and Tax Reforms, as well as other international roles.

As Acting Chairman of the FCT-IRS, Ango is expected to lead the agency toward achieving revenue optimization and transparency—objectives that align with Wike’s vision of a fiscally sustainable FCT. Wike, known for his hands-on governance and work ethic, has already outlined his agenda for boosting the FCT’s revenue. His approach involves restructuring administrative policies and tackling inefficiencies, with a mandate to expand the revenue base while minimizing the cost of doing business for investors and entrepreneurs. This strategy directly addresses longstanding challenges in FCT revenue collection.

Key challenges include fragmented revenue systems, inconsistent tax procedures, and high compliance costs, all of which have contributed to a difficult business environment. By unifying these revenue systems under a cohesive framework, the process can be streamlined, corruption reduced, and the ease of doing business enhanced, making the FCT more attractive to investors.

Central to Ango’s task is improving the Ease of Doing Business (EoDB). The simpler it is for businesses to operate, the more likely they are to thrive and contribute to the economic development of the region. For the FCT, improving EoDB requires removing bureaucratic hurdles, reducing compliance costs, and increasing transparency in tax administration.

Under Ango’s leadership, the FCT-IRS is poised to address these issues. His experience in modernizing tax systems and creating more efficient tax collection channels will be invaluable in achieving the revenue targets set by Wike. Streamlining multiple revenue collection agencies into a single, unified process will not only improve compliance but also foster a business-friendly environment.

Ango’s leadership will focus on several strategies to harmonize revenue collection and improve the ease of doing business. First, a unified digital revenue platform will be created to consolidate all revenue collection processes. This will simplify tax payments, reduce duplication, and improve compliance monitoring, ensuring that businesses meet their obligations efficiently.

Ango also recognizes the importance of capacity building for revenue officers. By enhancing their skills to manage the unified system, inconsistencies will be eliminated, accountability will improve, and tax collection efforts will be more effective.

In addition to capacity building, Ango will push for legal reforms. His extensive background in tax administration and law will drive the review of outdated legal frameworks that contribute to revenue system fragmentation. A harmonized tax system requires a strong legal foundation to ensure all agencies work toward a common goal.

Lastly, Ango will prioritize stakeholder engagement, consulting with business associations, government agencies, and civil society organizations to address concerns and encourage compliance. Public awareness campaigns through town halls, media engagement, and mass education will smooth the transition to a more efficient revenue system.

The appointment of Michael Hadi Ango as Acting Chairman of FCT-IRS marks a significant turning point in the administration of revenue in the nation’s capital. Together with the visionary leadership of Nyesom Wike, Ango’s proven expertise in revenue management will drive the FCT toward fiscal sustainability.

Leadership